Form 1040 Schedule D 2025 Schedule

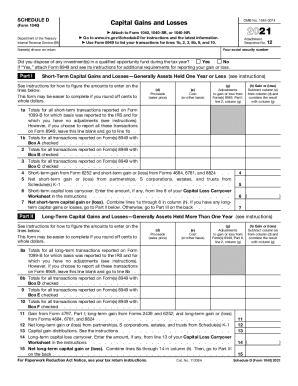

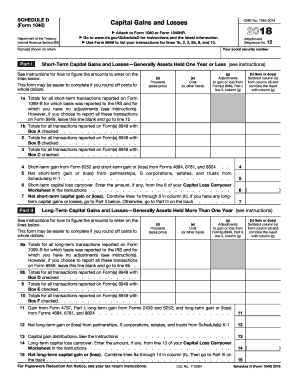

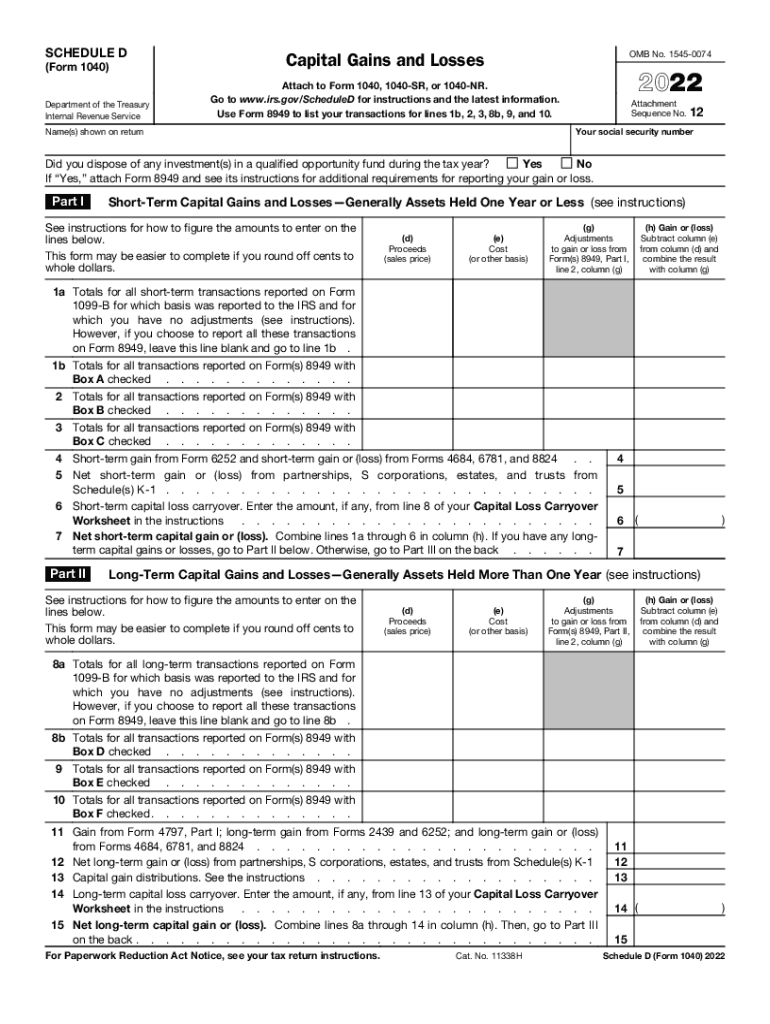

Form 1040 Schedule D 2025 Schedule – to figure their capital gain or loss on the transaction and then report it on Schedule D (Form 1040), Capital Gains and Losses. A taxpayer who disposed of any digital asset by gift may be required to . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

Form 1040 Schedule D 2025 Schedule

Source : www.investopedia.comForm 1040 for IRS 2025 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comWhat the 2025 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.com2025 Schedule D (Form 1040)

Source : www.irs.gov2022 1040 schedule d: Fill out & sign online | DocHub

Source : www.dochub.comHow to Report Crypto on Taxes: Forms 8949 & Schedule D | Koinly

Source : koinly.ioSchedule D (Form 1041) 2025 Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.comForm 1040 Schedule D 2025 Schedule When Is Schedule D (Form 1040) Required?: If you’re new to gambling, you may be surprised to learn that no matter the size of the winnings, whether cash or noncash, they must be reported to the IRS. . Here are our top picks for 2025 report it on your Form 1040 tax return, using both Form 8949, “Sales and Other Dispositions of Capital Assets” and Schedule D, “Capital Gains and Losses.” .

]]>:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)